The 65ᵉ session of the Franco-Russian seminar co-organized by the Centre d’Études des Modes d’Industrialisation of the École de Guerre Économique (Paris) and the Institute of Economic Forecasting of the Russian Academy of Sciences (Moscow) was held in Paris from July 3 to 5, 2023. Jacques Sapir, a well-known journalist and economist, gives an edifying account of the event, published on the “Les crises” website.

How has the Russian economy stood up to the sanctions imposed since the end of February 2022? This question has been much debated, often with more propaganda than fact. Let’s remember that the sanctions implemented against Russia since the start of hostilities in Ukraine have been deep and wide-ranging [1]. They come on top of the sanctions put in place after the events of 2014 [2]. Forecasters in both the West and Russia have produced often catastrophic predictions of what the Russian economy will look like by the end of 2022. Nevertheless, nothing dramatic has happened. This situation reminds us of another major forecasting failure in 1998-1999, following the Russian financial crash.

These sanctions had an impact, which was and still is acknowledged by the Russian authorities. But the question was, and remains, how much.

In the end, growth for 2022, which had been 3.5% in the two months preceding the sanctions, turned into a recession of -2.1%. This is certainly significant, but it is still much less than what had initially been forecast, with figures announced of -8% to -10%. Clearly, the Russian economy has not collapsed, either financially or economically, and the real impact of sanctions is the subject of much debate.

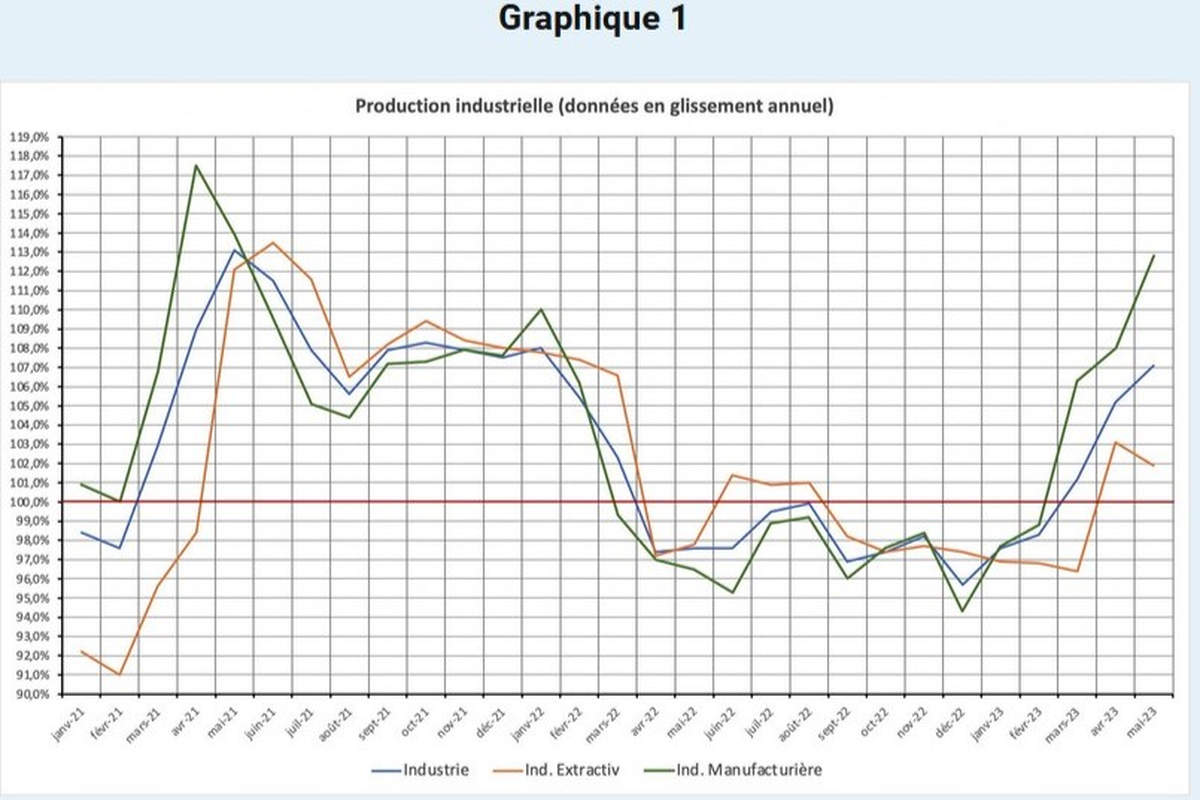

Moreover, by the end of the 1ᵉʳ half-year 2023, the Russian economy seems to have returned to fairly robust growth. For example, since the end of the first quarter of 2023, Russian industry has been enjoying what can only be described as excellent results. Production volumes and levels have returned to pre-sanctions levels. Importantly, this applies to all sectors, not just those with military potential. On the other hand, a microeconomic study shows that the impact of the sanctions has not yet been erased, although it is clearly being absorbed. Russian industry has regained its effectiveness, but not yet its efficiency. In other words, the economy and industry have returned to the production volumes of early 2022, but labor productivity has fallen.

A general review

Growth in industry and the economy in general, which had already been strong in April, accelerated sharply in May. Year-on-year, GDP (in the sense of material output) is said to have risen by 8.7% and, in the general sense, by 5.4% after 3.4% in April. Retail sales rose by 9.2%, and unemployment fell to 3.2% of the working population. Real wages are said to have risen by 10%. Industrial production rose by 7.1% (of which 12.8% for manufacturing and 1.2% for raw materials), agriculture by 2.9% and construction by 13.5%.

How can we explain such results, and also the Russian economy’s excellent resilience to what is, and remains, the most restrictive framework of sanctions ever taken against a country, apart from cases of war? In fact, the measures taken against Russia are akin to economic warfare. It would appear that the initiators of the sanctions, the United States and the countries of the European Union, underestimated the resilience of the Russian economy, its capacity for transformation, and the Russian government’s ability to react.

Sources: FSGS (ROSSTAT) Sotsial’no-Yekonomitcheskoe Polozhenie Rossii, n°5, 2023

The latter have been significant. The Russian government has provided a great deal of assistance to both the population and businesses. This level of aid is unprecedented in over a decade. The Ministry of Finance has lifted its restrictive policy, in particular the application of the “budget rule”. Businesses have also responded well. The increase in investment in 2022 (+5.4%), at a time when the economy was contracting, is the sign of this combination between public aid, spending on infrastructure and military orders from May-June 2022, and the reaction of companies. To this must be added the profits made by exporting companies (in hydrocarbons, but also by-products and chemicals). These profits may have fuelled significant direct investment, but they have also fuelled substantial orders to the rest of the industry. Business optimism began to take hold in the autumn of 2022, and is currently high. An important fact is that, since the beginning of 2023, profits in the non-oil and non-gas sector have grown faster than profits in the hydrocarbon sector. People’s real incomes have suffered from the high inflation seen in April-June 2022. However, the slowdown in inflation and a sharp rise in nominal wages led to overall stability in real wages in 2022 and an increase in the first half of 2023.

This has led to an increase in employment and a historic drop in the unemployment rate, which currently stands at 3.2% of the working population and could fall below 3% by the end of the year. Departures abroad have in fact been very limited (no more than 500,000 people in fact).

Industrial production has therefore returned to its December 2021 peak in May 2023, and manufacturing output for the first 4 months of the year is up 4.8% on the 2022 results. Forecasts for June 2023 indicate an increase of 7% to 8%. However, the impact of a significant base effect in industry needs to be taken into account, as data from March to May 2022 had been poor. This may partly explain the very good results for April and May 2023. But the data for April and May show that industrial production in volume terms has far exceeded its 2021 level. We are indeed in the presence of absolute growth.

Analysis by sector [3]

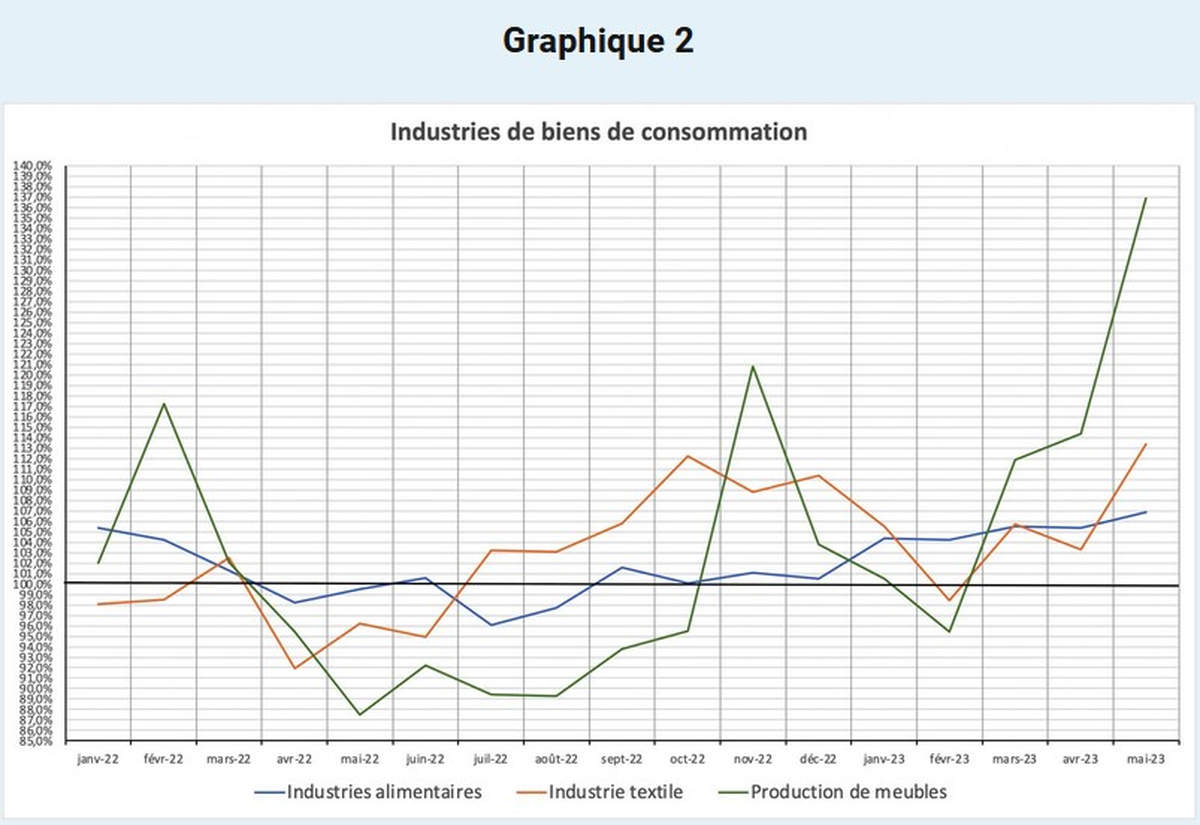

The dynamic of consumer industries (food, textiles, furniture), which had shown remarkable resistance to sanctions, except for furniture construction following the withdrawal of Western companies, is now experiencing a sharp acceleration. This could be explained by import substitution, and in particular by the very strong recovery in furniture construction in recent months. Overall, we can expect import substitution to develop rapidly in consumer goods, and to progress towards products with greater technological content.

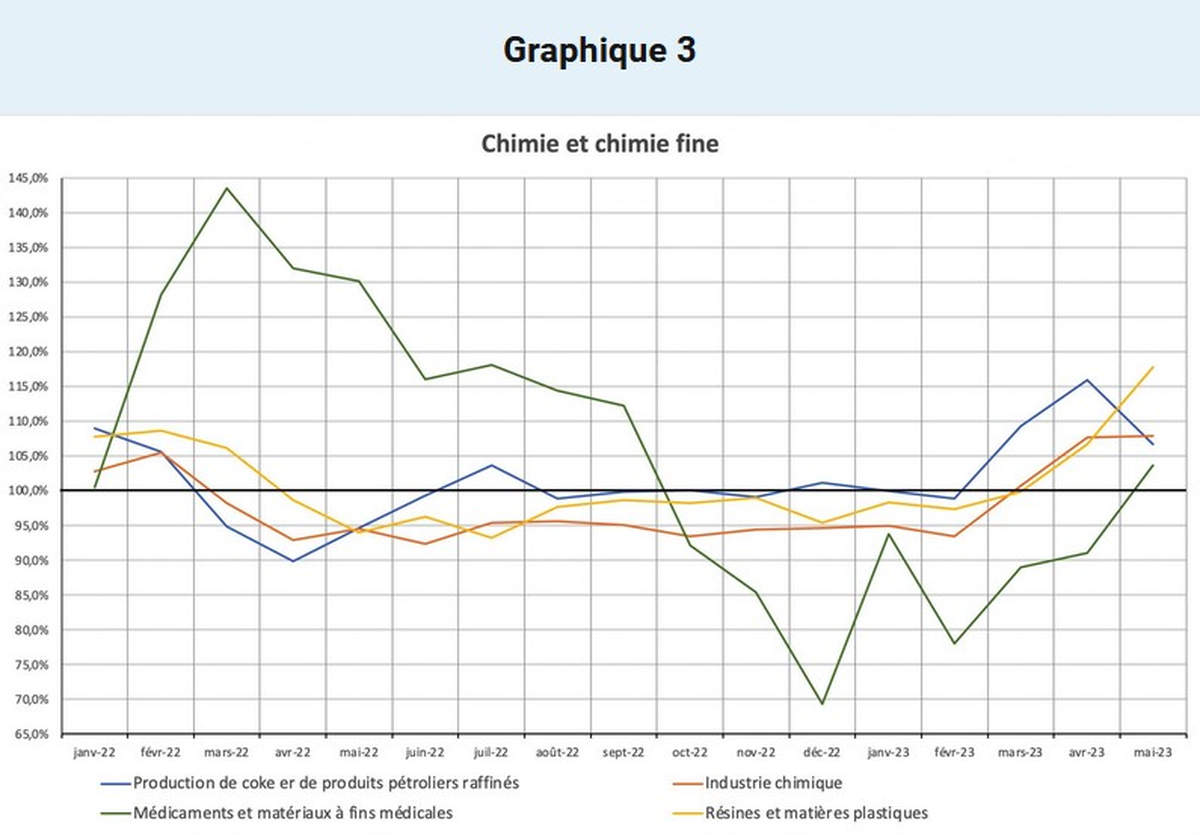

Chemicals and refining, which had seen declines of around -5% (which explains the drop in pollution observed by satellites over the second half of 2022 [4]), seems to have emerged from the slump since last March. Profit rates in these sectors were particularly high in 2022. This suggests that the financial means to finance investment exist in these sectors. Furthermore, while fertilizer production was limited for part of the year due to export restrictions (particularly in EU countries), the rise in powder and explosives production (linked to ammunition production) offset some of the production losses in the 2ᵉ half of 2022. Production of medicines and materials for medical use, meanwhile, is back at a good level, benefiting from public support for import substitution.

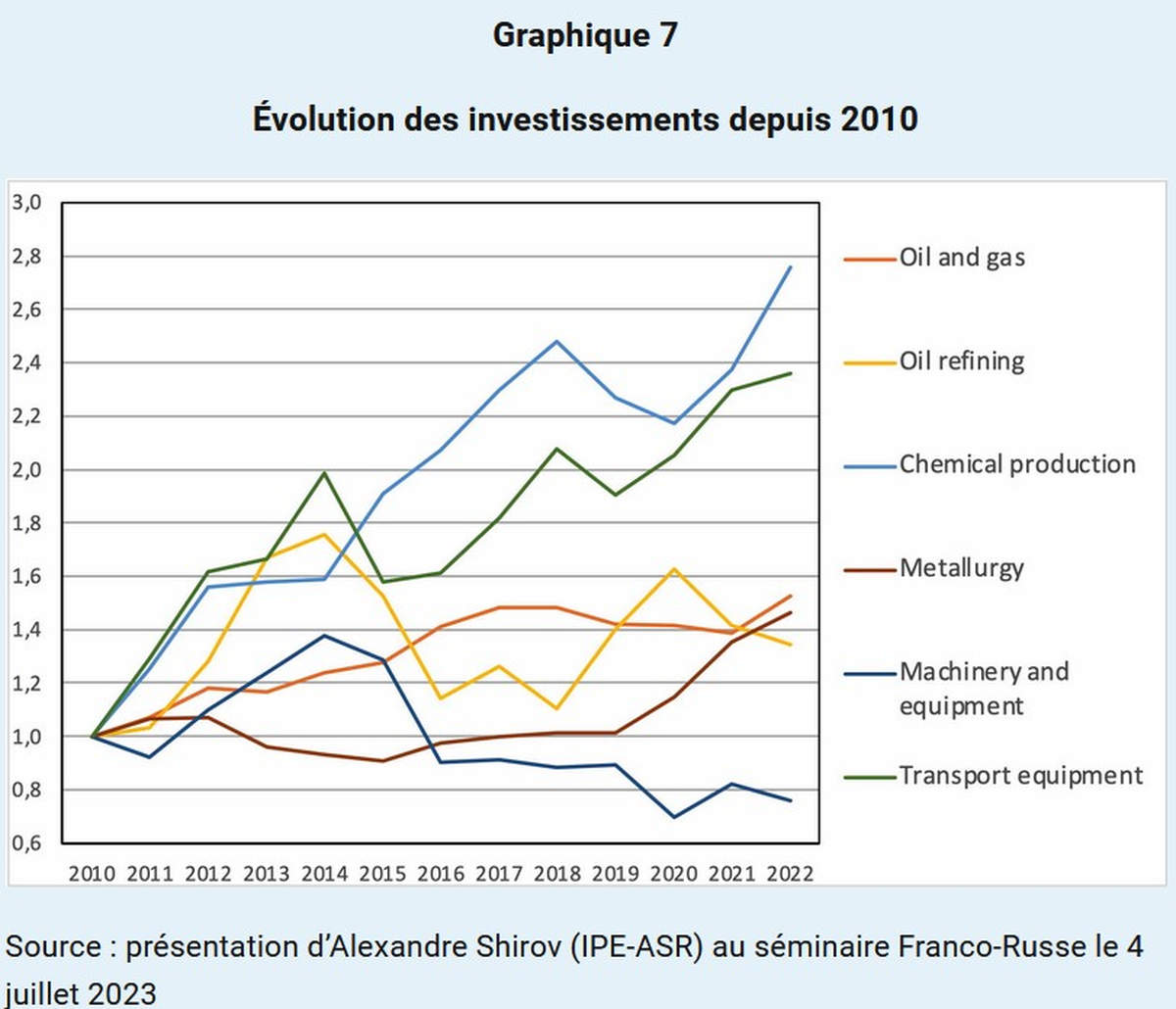

It should be noted that the chemical industry experienced a sharp rise in investment both before and after the COVID-19 crisis.

Metallurgy and metal products, a sector that was relatively unaffected by sanctions overall, is now enjoying impressive growth rates, particularly for metal products (profiles and rolled products).

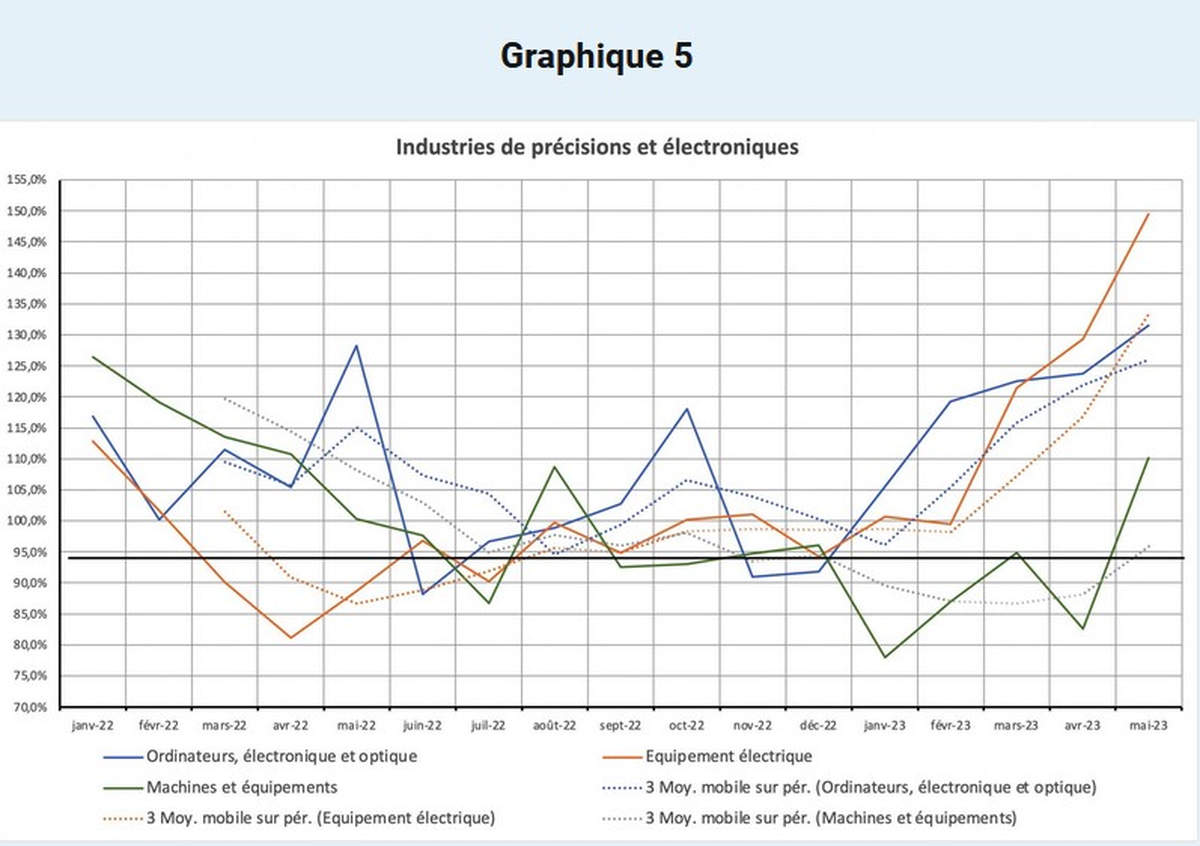

When we now look at production involving complex processes (electronics, optics, machinery and equipment), which should have borne the full brunt of the sanctions, not only do we see good resistance in 2022, but a clear acceleration in 2023. However, this sector includes many activities with military implications. It would not be surprising, therefore, if the latter had “pulled” up the overall results.

Military production

It was confirmed at the seminar that the three largest military production plants for land forces, Kurganmashzavod, Omsktransmash and Uralvagonzavod, had seen significant increases in production. For Kurganmashzavod, which had 1,700 employees before the outbreak of hostilities in Ukraine, employment would (by March 1, 2023) have risen to 3,900 (+129%). The number of hours worked would have risen by at least 10%. This explains the sharp rise in wages in the Kurgan oblast. This plant seems to specialize in the production and modernization of new infantry fighting vehicles. UralvagonZavod seems to have specialized entirely in the production of new tanks, while the upgrading of “old” tanks seems to have been entrusted to Omsktransmash (T-64 and T-80 upgrades).

For Uraltransmash and the land-based military repair factories, the increase in employment is at least +80%, and the factories have switched to a 2-shift regime (14 to 16 hours a day). If we haven’t yet reached a “wartime” regime (3 x 8 / 7 x 7), production has probably at least doubled. There has also been a sharp rise in employment, from 90% to 150%, in “techzavods” manufacturing components for missiles, airplanes and helicopters.

Nevertheless, production increases in electronics and electrical equipment over the last two months have been of such magnitude that the explanation of military orders cannot account for everything. It should also be noted that, logically, military production and orders should have risen sharply by June-July 2022. Here too, import substitution must have played an important role in explaining such an increase in production.

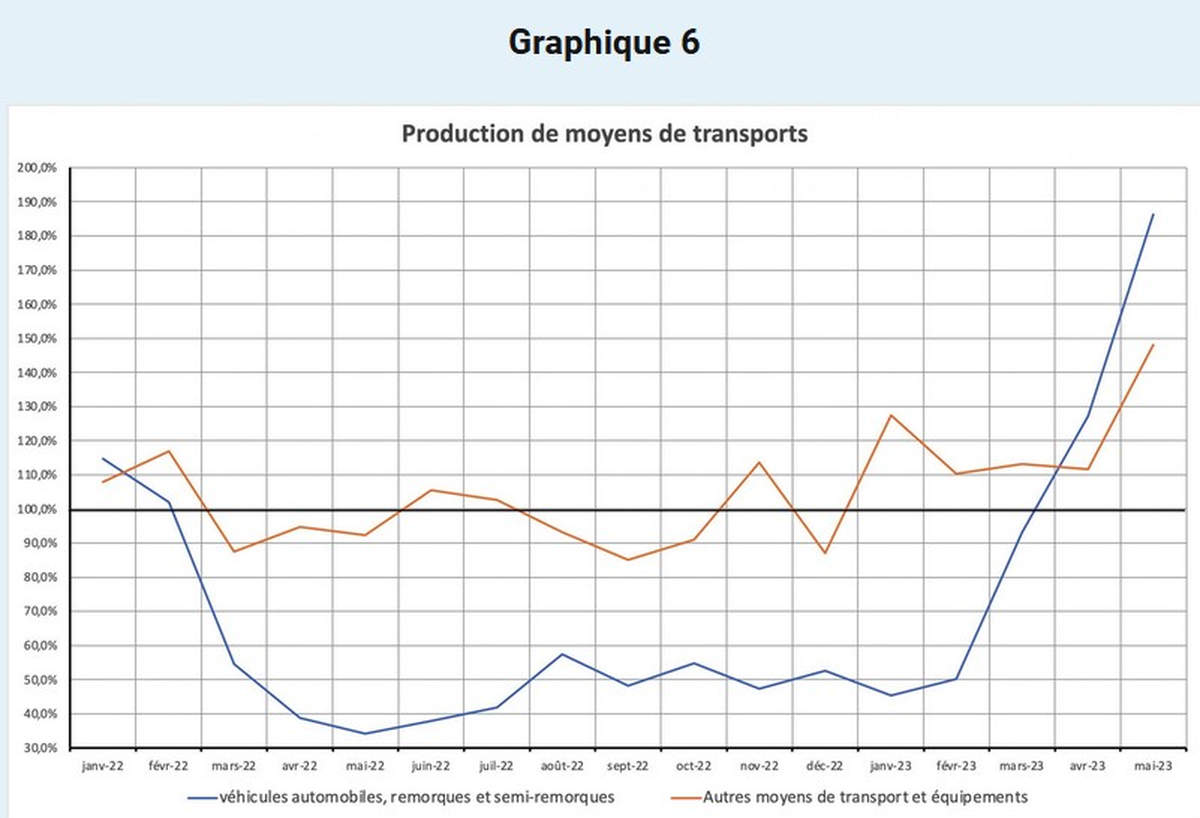

Finally, in the transport equipment sector, we note the significant impact of Western sanctions on car production (much less so in the case of trucks). Here, it took a year for production lines to be re-equipped under agreements signed with mainly Chinese producers. The models produced were changed or extensively modified to accept new components. The recovery of this branch in April (+30%) and May 2023 (+87%) is therefore spectacular.

Production of trucks of various types also rose sharply at the end of the second half of 2022 due to military orders.

Overall, the reaction of the various branches of industry during 2022 and early 2023 seems to have resulted from the following factors:

- Impact of sanctions on the supply of equipment and gradual easing of this impact due to the development of alternative sources for the supply of such equipment (automobile manufacturing, production of medicines and medical equipment, furniture manufacturing).

- The impact of sanctions has led to the closure of traditional export markets and the opening up of new markets, generally (but not exclusively) located in Asia (chemicals, metal products).

- Impact of import substitution policy and government support for this policy (food industry, electronics, electrical equipment).

- Household demand (depressed in Q2 and Q3 2022, recovering in Q4 2022 and Q1 2023).

- Importance of public procurement contracts, particularly those linked to military orders.

The impact of previous investments was also a factor. Some sectors are showing remarkable dynamism in terms of investments.

Overall, 55% of investment comes from companies’ own funds (self-financing), 10% from the banking system, 20% from public funds (budgetary and non-budgetary) and 15% from a mixture of securities issuance (2%) and loans granted by other companies as part of relationships with subcontractors.

Does this mean that Russian industry has fully recovered from the shock of sanctions? A more microeconomic analysis (a survey of several thousand companies carried out by the IPE-ASR under the direction of Dmitry Kuvalin) shows that this is not quite the case, although here too, the improvement in the situation is indisputable and shows significant potential for growth.

Companies’ reaction to the sanctions

In the first half of 2023, the recovery of the Russian economy from the post-crisis slowdown caused by large-scale external sanctions thus continued, with output growth observed in almost all key sectors of Russian industry. The half-yearly surveys carried out by the Institute of Economic Forecasting (IPE-ASR) in Moscow, on a base of over a thousand companies (excluding the energy sector) show both a process of adaptation by companies and the maintenance of certain difficulties. Business estimates point to an improvement in the situation and a gradual adaptation of the Russian economy to the sanctions. In particular, one year after the start of the new sanctions, 31.5% of companies surveyed immediately estimated that they had not suffered any negative effects from these sanctions, and 9% that they had not suffered any consequences “for the time being”.

Table 1

Has your company been affected by the sanctions

| Apr-May 2022 | Nov-Dec 2022 | Apr-May 2023 | |

| Yes | 59,20% | 66,20% | 60,60% |

| No, not at the moment | 22,30% | 14,60% | 7,90% |

| No | 18,50% | 19,20% | 31,50% |

| (Total no) | 40,80% | 33,80% | 39,40% |

The proportion of optimistic assessments was significantly higher than in the 2022 surveys. However, the proportion of respondents affected by sanctions remains high at 60.6%. In other words, despite positive developments, the impact of sanctions on Russian businesses as a whole remained significant, albeit highly variable.

Table 2

Have the sanctions had an impact on your company?

| Nov-Dec 2022 | Apr-May 2023 | |

| No consequences | 16,20% | 18,90% |

| Positive consequences | 0,80% | 3,90% |

| Positive and negative consequences | 20,80% | 24,40% |

| Negative consequences | 56,90% | 46,50% |

| No opinion | 5,30% | 6,30% |

The proportion of respondents declaring that they had only suffered negative effects from the sanctions fell from 56.9% at the end of 2022 to 46.5% in spring 2023. At the same time, the proportion of respondents who believe that the sanctions have had no particular consequences for them has risen slightly over the same period from 16.2% to 18.9%. The proportion of those who said the sanctions had had positive consequences also increased, to 34.6%. Companies continue to point to the existence of specific problems caused by sanctions. As in 2022, the most pressing problems include :

- Difficulties in sourcing imported raw materials and components (61.9% of responses),

- Price increases (61.1%),

- An increase in overall uncertainty in the economy (45.2%),

- The rising cost of imports (44.4%).

At the same time, there has been no noticeable increase in the problems associated with sanctions. The frequency of reports of negative effects has decreased, while that of “positive” effects has increased. For example, compared with the end of 2022, problems obtaining imports, reduced export opportunities and restrictions on technology imports have begun to be mentioned less frequently. Most likely, such a dynamic of responses is associated with the gradual establishment of alternative channels for cross-border supplies, as well as the strengthening of import substitution processes.

Table 3

What measures has your company taken in response to the sanctions?

| Apr-May 2022 | Nov-Dec 2022 | Apr-May 2023 | |

| Reducing personnel costs | 11,50% | 12,60% | 11,20% |

| Reduce investment | 36,90% | 30,70% | 34,80% |

| Stop production of certain products | 14,80% | 18,10% | 8,00% |

| Searching for new suppliers in Russia | 69,70% | 78,00% | 67,20% |

| Search for new suppliers abroad | 36,10% | 42,50% | 34,00% |

| Start production of new products | 21,30% | 27,60% | 20,60% |

| Searching for new markets | 31,10% | 39,40% | 41,20% |

| Restructuring and modernizing production for the future | 14,80% | 33,10% | 32,80% |

The predominance of “active” over “passive” methods of adapting to sanctions is becoming increasingly apparent. In particular, in spring 2023, the share of responses concerning various types of cost reduction continued to decline. The share of responses on reducing investment costs fell from 36.9% in spring 2022 and 30.7% at the end of 2022 to 24.8% in spring 2023. Similarly, the proportion of responses concerning the cessation of production of certain product types fell from 18.1% at the end of 2022 to 8.4% in spring 2023. At the same time, the frequency of reports on the search for alternative suppliers in Russia and abroad, the launch of production modernization processes and the search for new sales markets remained high.

The speed with which companies adapt to sanctions depends largely on support from the authorities. Russian companies’ views on the type of support measures the authorities should implement by the end of spring 2023 have not changed much compared to the 2022 responses. In terms of frequency of mention we have:

- Reducing (or curbing) energy and transport prices (54.0% of responses),

- Reducing bureaucracy (46.8%)

- Reduced tax burden for producers (46.0%)

- Supporting demand in the economy through public procurement (43.7% of responses),

- Financial support for import substitution (38.9%)

- The launch of major infrastructure projects (36.5%).

Responding to questions on the role of the state under current conditions, the majority of companies surveyed, as before, favored the continuation of a more active state economic policy. In spring 2023, 44.4% of respondents were in favor of increased state intervention in the economy through indirect methods, and 11.3% were in favor of increased direct intervention.

At the same time, around a third of companies favored some reduction in the role of the state in the economy. If we analyze the dynamics of responses to the question on the desirable role of the state in the economy over the past 10 years, the share of those in favor of a more active state has slowly declined, while the share of those in favor of the opposite view has grown.

In all likelihood, this trend indicates a gradual increase in Russian companies’ confidence in their own strength.

Notes

[1] https://www.piie.com/blogs/realtime-economics/russias-war-ukraine-sanctions-timeline

[2] See: https://www.europarl.europa.eu/news/fr/press-room/20140331IPR41184/liste-magnitsky-des-sanctions-europeennes-contre-32-hauts-responsables-russes

[3] Sources of the various graphs: FSGS (ROSSTAT) Sotsial’no-Yekonomitcheskoe Polozhenie Rossii, n°5, 2023, p.26, 32, 60-61, 39-40, 41, 43, 45, 48-49, 51, 52-53, 54, 55-56, 57-58, 58-59

[4] Rosen P., “Russia’s economy is suffering from industrial decline as satellites detect less pollution in the air”, May 5, 2023, Markets Insider, https://markets.businessinsider.com/news/stocks/russian-economy-industrial-decline-air-pollution-satellite-data-ukraine-war-2023-5

Next article:

How the Russian economy has thwarted Western “economic warfare” measures: What growth for 2023? (2/2)