By 2023, the public deficit will have risen to 5.5% of GDP, and public debt to 110.6% of GDP, according to INSEE. This slippage is an embarrassment for the government.

The public deficit for 2023 stands at €154.0 bn, or 5.5% of gross domestic product (GDP), after 4.8% in 2022 and 6.6% in 2021, reveals Insee. Bercy had forecast a deficit of 4.9% in the Finance Act for 2024.

Revenues slow significantly in 2023, rising by 2.0% after +7.4% in 2022.

The rate of compulsory levies falls to 43.5% of GDP after 45.2% in 2022, close to the pre-Covid level (43.9% in 2019). Expenditure slows slightly, rising by 3.7% after +4.0% in 2022. As a proportion of GDP, spending continues to fall, to 57.3% of GDP after 58.8% in 2022 and 59.6% in 2021, but remains significantly higher than before Covid (55.2% of GDP in 2019). General government debt in the Maastricht sense will reach 110.6% of GDP at the end of 2023, after 111.9% at the end of 2022; it was 97.9% of GDP in 2019.

Concerns for the future

The announcement of these poor figures for the French economy prompted a number of reactions, starting with the first president of the Cour des Comptes. Speaking on France-Inter, Pierre Moscovici asked: “How can we invest in the future, in energy transition, digital technology, research and defense, when we are 110% in debt? The debt burden is already 57 billion euros a year, and it will be 87 billion euros by 2027.”

The opposition is not to be outdone. “We’re on the same path as Greece,” says Eric Ciotti, head of the Républicains party. “Emmanuel Macron will be the man with 1,000 billion in debt”.

The leader of the LR senators, Bruno Retailleau, waxes lyrical: “The two mandates of Emmanuel Macron, who was described as the Mozart of finance, risk ending with a requiem for public finances.”

“White-collar crooks”

As for the General Secretary of the PCF, he’s not into half-measures. He accuses the government of being made up of “white-collar crooks… Who have made impossible gifts to the richest, to capital, to dividends, to the CAC 40!”

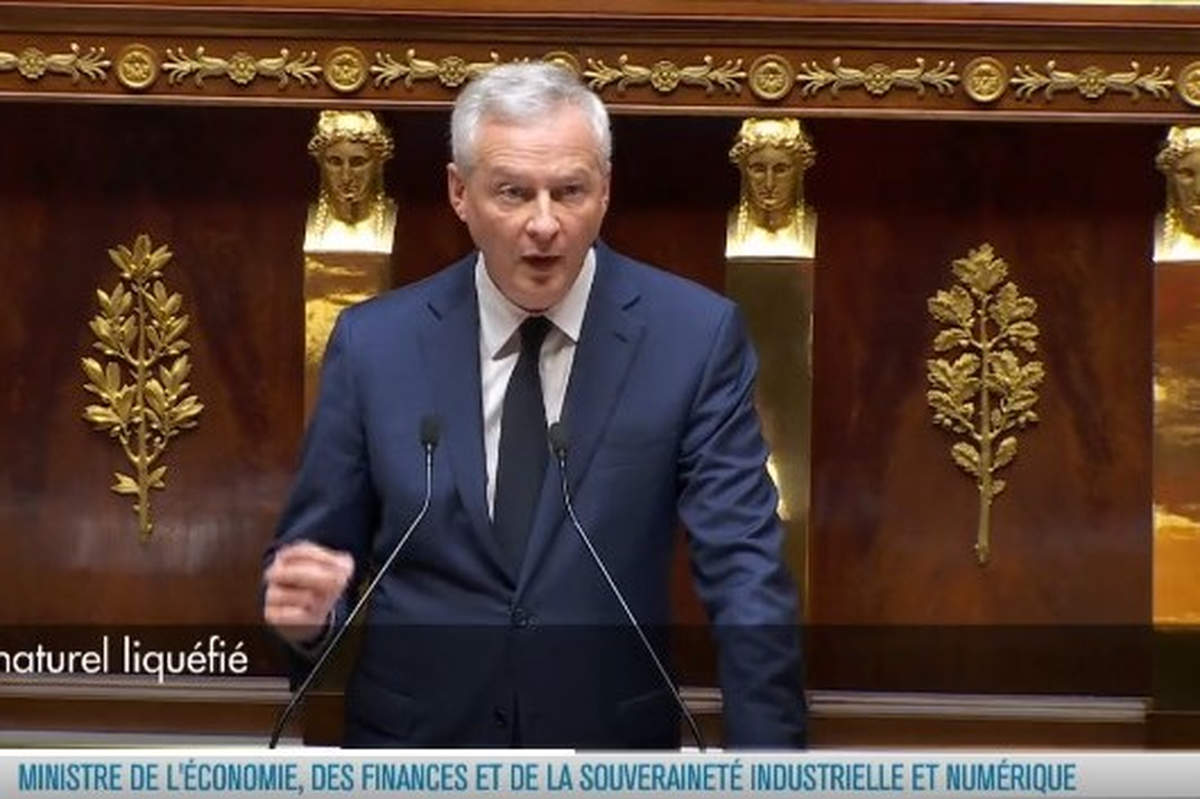

It’s true that the debt is abysmal, the deficits gigantic, and that we’ll have to pay for it one day. But Bruno Le Maire, Minister of the Economy for the past seven years, is still deluding himself: “Believe me, my determination to restore public finances and get back under the 3% public deficit by 2027 is intact, I’d even say it’s total.”

But who can still believe it?

Éric Ciotti, président des Républicains et député des Alpes-Maritimes : "Emmanuel Macron sera l'homme des 1000 milliards de dette" #LeGrandRDV #Europe1 pic.twitter.com/zemMQ6NBfv

— Europe 1 (@Europe1) March 24, 2024