While the World Bank expects a strong increase in remittances to Ukraine, UFC-Que Choisir is warning financial institutions and public authorities about their “unethically expensive” fees.

Lauding the initiative of some European banks to waive their money transfer charges, which outweigh the total amount of European humanitarian aid provided to Ukraine, the association calls for a rapid reduction in remittance fees.

€900 million remittances fees to Ukraine in 2020

Following the crisis in Ukraine, many consumers have been helping their fellow countrymen with donations. This is particularly true of those who transfer funds to their relatives who have not yet been able to flee the war or who wish to remain in their country.

While we would expect these remittances to fully benefit those most in need, this objective will not be met. In

2020 alone, remittances fees to Ukraine reached over €900 million , almost twice the amount of humanitarian aid announced by the European Commission. Indeed, for a remittance of €180 from the EU to Ukraine , banks and money transfer companies charge an average of almost €11.

Up to 24% charge on remittance from France to Ukraine

UFC-Que Choisir assesses that remittances from France to Ukraine brought in around €5 million for financial institutions in France in 2020 , with significant price discrepancies.

Among the offers on the market, bank transfer fees are by far the most expensive. At €30 on average , the gap cannot but raise concerns about the margins charged as those fees can reach to a quarter to the sum sent at Crédit Agricole Pyrénées Gascogne (24%). Worse, through this channel, the recipient may even be charged, even though almost one out of two banks allow the sender to bear these costs for an additional €20 on average.

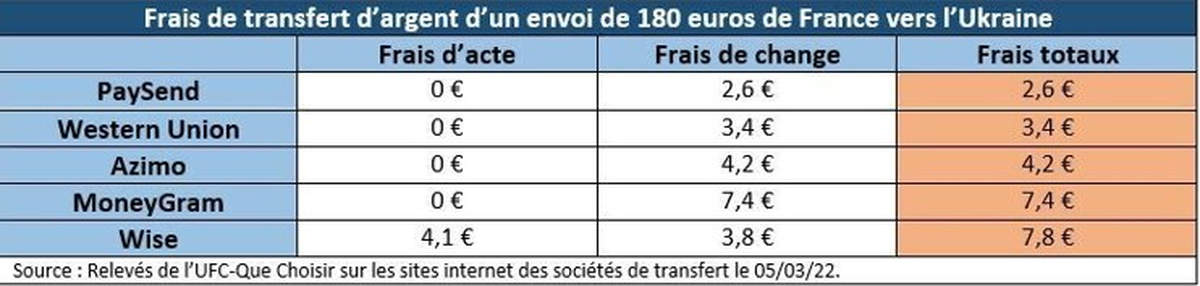

While remittances through money transfer companies are still much more competitive, averaging €5, caution

should be exercised regarding hidden exchange charges, as the following table shows.

Amongst our panel, only Wise clearly states that it charges a transfer. Under the cover of offering free sending, the other money transfer companies charge exchange fees that can be very high. As a result, among the latter, remittance fees vary from a simple (€2.6 at PaySend) to a triple (€7.4 at MoneyGram).

A few European banks to waive their remittances charges

While it is rather difficult to expect consumers to be able to shop around during such events, those expensive charges must be put into question at the French and European level as remittances from the EU to Ukraine are expected to reach at least €12 billion in 2022 .

Indeed, based on a World Bank study, a 2-percentage point reduction in transfer fees could provide

Ukrainians with an additional €350 million in aid this year. In this respect, while the initiative of some European banks including La Banque Postale since 8 March, which have announced their intention to waive their remittances charges is to be welcomed, it is regrettable that this approach has not yet been emulated, particularly by French banks.

Consequently, UFC-Que Choisir asks that the French presidency of the Council of the European Union takes up the issue of money transfer fees to Ukraine in order to obtain from financial institutions at least a rapid reduction in fees.

NOTES

[1] Quote from Kofi Annan, former Secretary General of the United Nations, at the release of the Annual Report of the African Development Foundation in 2014.

[2] Russia-Ukraine Conflict: Implications for Remittance flow to Ukraine and Central Asia, Policy Brief 17, 4th March 2022, KNOMAD.

3] EUR 500 millions. Speech by President von der Leyen on Russia’s aggression against Ukraine to the plenary of the European Parliament, 1st March 2022, European Commission.

[4] Russia-Ukraine Conflict: Implications for Remittance flow to Ukraine and Central Asia, Policy Brief 17, 4 mars 2022, KNOMAD. EUR 180 for a remittance is the equivalent of USD 200 used by the World Bank to compute fees. The average is calculated by UFC-Que Choisir based on the fees collected by KNOMAD adjusted by the weight of the main European countries in remittances to Ukraine.

[5] Estimation based on remittances flow sent from France to Ukraine according to the sending channel (bank or money transfer company) reported by the National Bank of Ukraine in 2020.

[6] Survey of tariffs from the price brochures of 16 of the 21 representative banking institutions according to the Observatory of bank tariffs from the Comité consultatif du secteur financier. 5 institutions are not included in this survey since they do not specify the amount of their exchange fees.

[7] Russia-Ukraine Conflict : Implications for Remittance flow to Ukraine and Central Asia, Policy Brief 17, 4 mars 2022, KNOMAD. The World Bank forecasts an increase in remittances to Ukraine of 8% in 2022. Two-thirds of remittances were sent from an EU member state in 2021. However, this proportion is expected to grow strongly.

[8] Ibid. More precisely, a 2 percentage point reduction in tariffs would allow senders of remittances to save 350 million euros according to the World Bank. This saving could then be added to the sums they send to their relatives.

[9] Revolut, Bank of Ireland, AIB, Caixa Geral de Depósitos, Santander Totta.

[10] Transfers initiated at La Banque Postale as part of its partnership with Western Union have been free since 7 March.