“How to reconcile food sovereignty, better remuneration for the agricultural world while meeting the challenges of tomorrow when 2021 marks the 8th consecutive year of deflation for our industry,” asks the National Association of Food Industries (ANIA)? Undoubtedly by increasing prices in stores.

The National Association of Food Industries brings together 32 trade unions and 15 regional associations, representing the food industries in France. The food industry is the first French industrial sector with a turnover of 176 billion euros and the first industrial employer with 427 594 employees. However, it is experiencing major difficulties, as highlighted in an ANIA economic report.

98% of small and medium-sized companies

The importance of the food industry in France is no longer in question. With more than 18% of the industrial turnover, 16% of its added value and nearly 500,000 jobs, the sector counts and weighs heavily in the economic activity of our territory. This industry transforms 70% of French agriculture and provides a daily living for many farms: 80% of the food products consumed in France are manufactured locally.

The food industry is made up of 98% of small and medium-sized enterprises (SMEs) that contribute to the development and economy of the region. This is essential when we know that over the last 20 years, 80% of the jobs created have been in SMEs.

The generalized return of deflation on the shelves since 2020, confirmed by the latest assessment of trade negotiations (deflation of -0.3%, in a context of explosion of some agricultural raw materials and a tariff need of 3% raised by suppliers) plunges manufacturers into a particularly complex equation in 2021: to contribute to food sovereignty in the long term, through an investment effort, increased innovation, in a context where the decline in profitability has never been as strong as in recent months. However, there can be no food sovereignty without an immediate and lasting end to the price war.

The price war

1- The food industry and its 17,000 companies are still weakened by the price war in supermarkets: manufacturers’ margins collapse in 2020

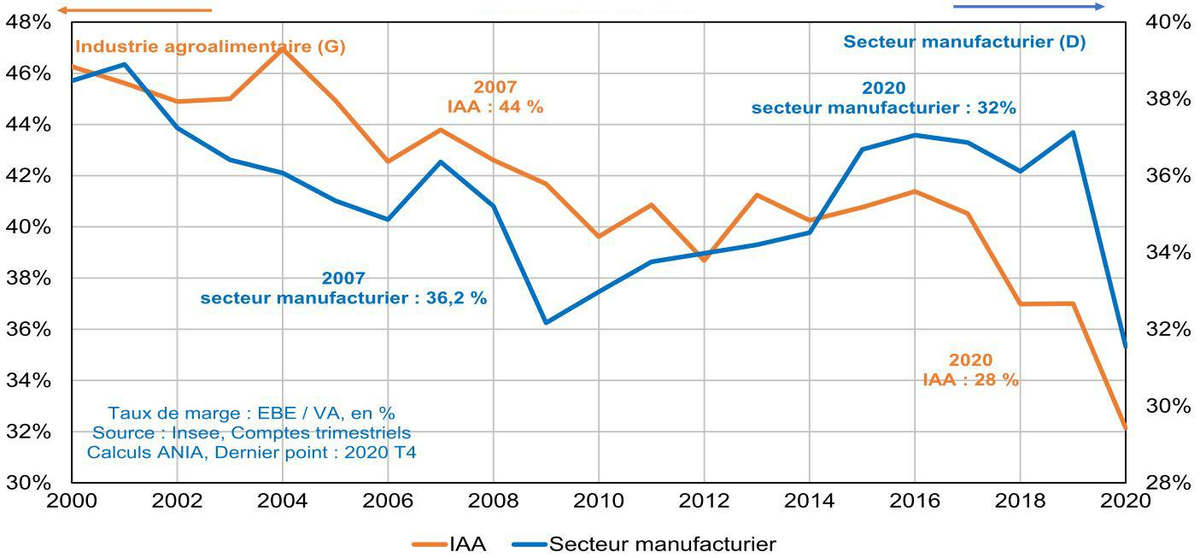

The financial health of the food industry, as measured by the margin ratio, deteriorated significantly in 2020, continuing a trend that has been in place since 2007 (and has been particularly marked since 2017). Recall that this ratio is used to assess the profitability of food companies and the share of value added that is retained by its companies, an essential resource for innovation, investment and modernization of the production tool, meeting the expectations of consumers and markets. Between 2007 and 2020, this ratio has lost 16 points, including 7 points since 2017! That is a drop of around 40% over the last 14 years!

In this context of strong tension on the level of equity, lack of visibility on the exit of the crisis and the future direction of markets, the investment of food companies has fallen heavily in 2020 (-5%), a fact not seen since 2015, at the height of the price war.

Food industries are caught between deflation in consumer packaged goods (CPGs) and continued increases in raw materials, energy and transportation:

▪ Deflation specific to the food industry (-6.2% between 2013 and 2020), when overall inflation was increasing by 6% over the same period. Business Outlook 10 May 2021

▪ High volatility and upward trend in raw materials, not passed on to the downstream sector. Over the most recent period, the price of food and industrial raw materials is moreover particularly dynamic:

– +17% for all food raw materials,

– strong tensions also on packaging: increase of almost 40% for plastic packaging, + 34% for aluminum, or 50% for paper / cardboard…).

These tensions on the cost and availability of supplies have increased in recent months. In a context of persistent price wars in supermarkets and hypermarkets, their consequences will affect the entire sector in 2021.

80% of food products manufactured in France

2- For 2021, an imperative: recreate the conditions for creating value for the food industry to meet the objective of food sovereignty

If we stick to the analysis of “raw” data, France remains sovereign, especially compared to other processing industries: 80% of food products consumed by the French are manufactured in France. This is an asset that must be preserved because it is essential to the economic dynamism of the regions and to the preservation of local employment.

In a context of declining added value, specific to France (-14.5% over the last 10 years compared to 13.4% for the entire euro zone), new obligations and excessive constraints in terms of transparency of agricultural purchase prices would run counter to the desired objective and would put the food industry at a substantial competitive disadvantage. Industrialists could be forced to source their supplies abroad or even relocate their production sites, which would be totally contrary to the objective of food sovereignty assigned to the players in the sector.

3- ANIA asks: to reinforce the tariff of the suppliers, the notion of a reasonable and and reasonable food inflation should no longer be taboo!

Aligning food inflation (-0.1% in 2020) to a level in line with that observed for all sectors of activity (+0.6%) would result in a contribution of only €1.5 per household per month. The battle for purchasing power is not being fought in the supermarket shopping cart. The return to food inflation, without affecting the purchasing power of households, would save the entire food industry, which has already been largely shaken, from the harmful consequences of the price war.

To get out of the deleterious pattern of the price war, there is only one option: to ensure the strengthening of the supplier’s tariff, a sine qua non condition for the revaluation of agricultural income :

▪ Negotiations must start from the general sales conditions and not from the agreed price of the year N-1,

▪ Any tariff degradation must give rise to proportionate and verifiable counterparts.